CT DRS CT-1040 2009 free printable template

Show details

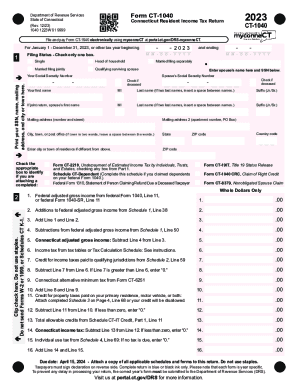

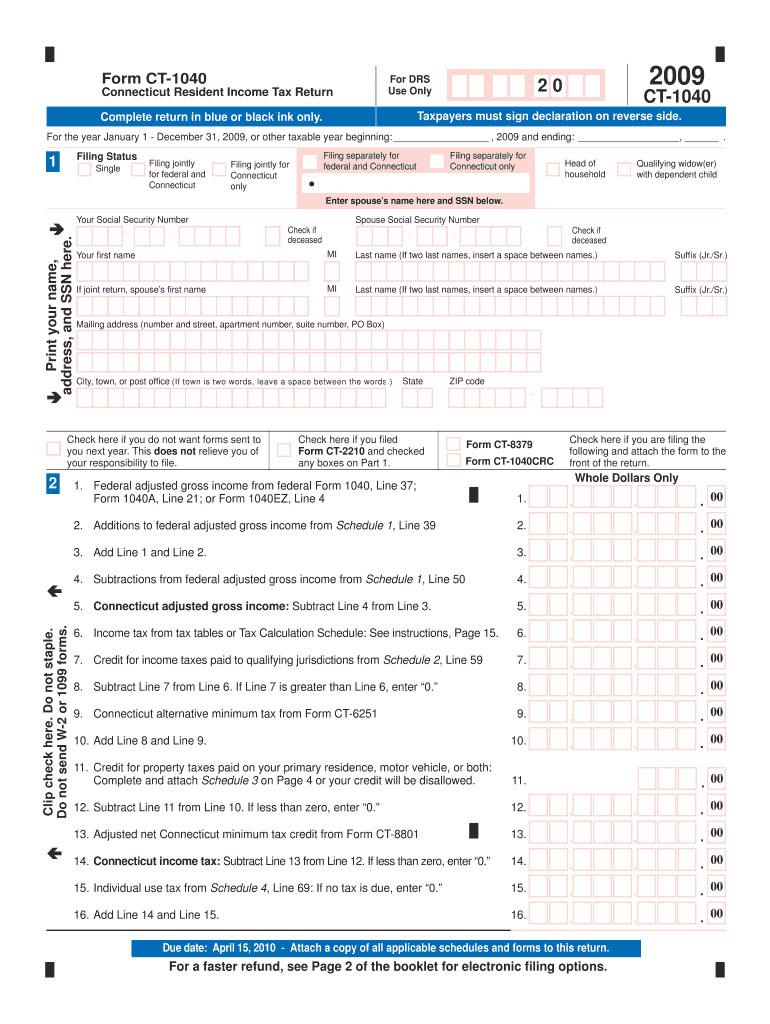

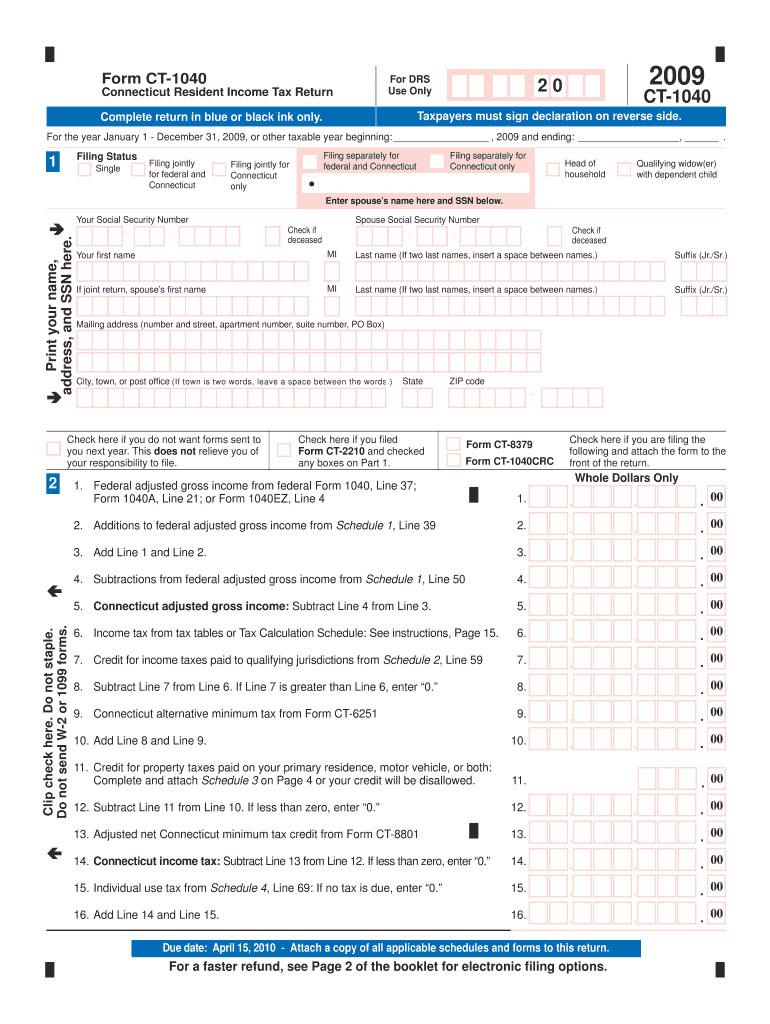

Form CT-1040 Connecticut Resident Income Tax Return Complete return in blue or black ink only. For DRS Use Only 20 CT-1040 2009 Taxpayers must sign declaration on reverse side. For the year January

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ct 1040 form 2009 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct 1040 form 2009 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct 1040 fillable form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ct 1040 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

CT DRS CT-1040 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ct 1040 form 2009

How to fill out ct 1040 form?

01

Gather all necessary documents such as W-2 forms, 1099 forms, and any other income or deduction records.

02

Begin by entering your personal information including your name, address, and social security number on the designated sections of the form.

03

Follow the instructions on the form to report your income, including wages, tips, and self-employment earnings. Be sure to accurately report any income from investments or rental properties.

04

Determine your deductions and credits by referring to the instructions provided with the form. These may include deductions for student loan interest, mortgage interest, and medical expenses, as well as credits for child care expenses or education expenses.

05

Calculate your taxable income by subtracting your deductions and credits from your total income.

06

Determine your tax liability by referencing the tax tables or tax rate schedules provided with the form. Enter the amount on the designated section.

07

If you are owed a refund, provide your bank account information for direct deposit. If you owe taxes, arrange for payment through a check or electronic payment method.

08

Double-check all calculations and ensure that you have signed and dated the form before submitting it.

Who needs ct 1040 form?

01

Residents of Connecticut who are required to file a state income tax return.

02

Individuals who earned income in Connecticut or have residency in the state for tax purposes.

03

Taxpayers who need to report their income, deductions, and credits specific to the state of Connecticut.

04

Those who may be eligible for state-specific tax exemptions, credits, or deductions.

Fill form : Try Risk Free

People Also Ask about ct 1040 fillable form

What do you need in order to fill out your 1040?

Is there a fillable 1040 form?

How to fill out 1040 form online?

How do I fill out a 1040 step by step?

Can you fill out tax forms digitally?

Does Connecticut have an efile form?

Can I file a 1040 easy online?

Can you fill out 1040 by yourself?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file ct 1040 form?

The Connecticut 1040 form is required to be filed by any Connecticut resident who has Connecticut gross income of $12,000 or more, or any part-year resident with Connecticut gross income of $2,000 or more.

What is the purpose of ct 1040 form?

The Connecticut 1040 Form is the state's individual income tax return. It is used to report income, calculate taxes, and determine any refund or balance due.

When is the deadline to file ct 1040 form in 2023?

The deadline for filing a Connecticut Form 1040 in 2023 is April 18, 2024.

What is ct 1040 form?

The Connecticut Form CT-1040 is the official state income tax return form for residents of Connecticut. This form is used to report and calculate the amount of state income tax owed by the taxpayer based on their annual income and other factors. The CT-1040 form includes various sections and schedules for reporting different types of income, deductions, and credits.

How to fill out ct 1040 form?

To fill out the CT 1040 form, you will need the following information:

1. Personal Information: Provide your full name, Social Security number, and address.

2. Filing Status: Indicate your filing status (e.g., Single, Married filing jointly, Married filing separately, Head of household).

3. Income: Report all sources of income, such as wages, salaries, tips, interest, dividends, rental income, and business income. Use the appropriate lines on the form to enter the amounts.

4. Adjustments: If you qualify for any deductions or adjustments to your income, such as contributions to retirement accounts or student loan interest, enter these amounts on the appropriate lines.

5. Tax Credits: If you qualify for any tax credits, such as the Earned Income Credit or Child and Dependent Care Credit, provide the required information and calculate the credit amount.

6. Calculate Tax Liability: Use the tax tables or the tax rate schedule provided in the instruction booklet to determine your tax liability based on your taxable income.

7. Withholdings and Estimated Payments: Report any taxes withheld from your income by employers or make adjustments for estimated tax payments. Enter these amounts in the appropriate lines.

8. Calculate Refund or Payment: Subtract your total tax liabilities from your credits and payments to find your net tax due or refund amount.

9. Sign and Date: Don't forget to sign and date the form before mailing it.

It is recommended to review and follow the instructions provided with the CT 1040 form to ensure accuracy and completeness. Additionally, if you are unsure or have complex tax situations, it may be helpful to consult a tax professional for assistance.

What is the penalty for the late filing of ct 1040 form?

The penalty for late filing of Connecticut Form CT-1040 (individual income tax return) is generally 10% of the tax due, with a minimum penalty of $50. If the failure to file is determined to be intentional, the penalty may increase to 25% of the tax due. It is important to note that interest may also be charged on any unpaid tax balance.

What information must be reported on ct 1040 form?

The CT 1040 form is the Connecticut Individual Income Tax Return. The following information must typically be reported on this form:

1. Personal Information: Name, social security number, address, and filing status (Single, Married filing jointly, Married filing separately, Head of household, or Qualifying widow(er)).

2. Income: Report all sources of income including wages, salaries, tips, self-employment income, rental income, interest, dividends, capital gains, pensions, and retirement income.

3. Deductions: Itemized deductions for expenses such as mortgage interest, real estate taxes, medical expenses, charitable contributions, and state and local taxes paid during the tax year.

4. Credits: Claim any applicable tax credits, such as the Earned Income Credit, Child and Dependent Care Credit, Property Tax Credit, Business Tax Credit, or Education Tax Credit.

5. Connecticut Withholding: Report the total amount of Connecticut income tax withheld from wages.

6. Payments and Refunds: Report any estimated tax payments, extension payments, or any other payments made throughout the tax year. Also, report any refund received or applied from the previous year.

7. Additional Information: Report any additional information required by the form instructions, such as federal adjusted gross income and Connecticut taxable income.

It is worth mentioning that tax forms and requirements may change from year to year, so individuals should always refer to the latest version of the CT 1040 instructions or consult a tax professional for accurate and up-to-date information.

How do I modify my ct 1040 fillable form in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your ct 1040 form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an electronic signature for the form ct 1040 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your ct 1040 form in minutes.

How do I complete ct1040 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your ct1040 form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your ct 1040 form 2009 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ct 1040 is not the form you're looking for?Search for another form here.

Keywords relevant to ct tax forms fillable

Related to ct quarterly tax form online fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.